Getting your finances in order might seem like a never-ending task. As you advance in your career and life, there are only more things to track and be mindful of. Questions about whether you’re making the most of your investments can come to mind. You might also wonder whether your budgeting and spending habits are appropriate or out of hand.

Luckily, technology exists to make the world of personal finance a bit easier. Tech can help monitor and automate some of those easy-to-forget money management tasks. Thankfully, technology can also give your financial situation a boost. Here are four tech hacks for your finances you should consider using.

1. Digital Investment Tools

Source: unsplash.com

Deciding what to include in your investment portfolio can be tricky. Conventional wisdom says if you’re young, you should invest more in stocks. However, choosing an optimal mix of equities requires some calculation.

You’ve got to start with your goals, look at each stock’s expected rate of return, and take a leap. Afterward, there’s constant portfolio monitoring and the need to make changes when an investment underperforms.

Fortunately, digital investment tools can help remove some of the guesswork. By plugging in your age, timeline, and goal, you can see what your portfolio should look like.

That might mean allocating a percentage to stocks, bonds, and alternative investments like cryptocurrency and REITs. According to Rocket Dollar, an REIT is an alternative investment trust that lets you buy a stake in real estate properties without managing them. You get the potential profits without a landlord’s headaches.

Digital investment tools can provide additional recommendations and alerts, including reports and analytics. The software also makes changes to your portfolio mix as you near retirement or other goals.

Instead of crunching the numbers yourself, you’ll have performance forecasts within minutes. Plus, you’ll know when your portfolio’s results are misaligned with your goals. You can respond faster and more strategically to get things back on track.

2. Credit and Debit Card Alerts

Source: unsplash.com

It’s way more convenient to pay with a credit or debit card than it is to carry cash. Paper money and coins can get lost and accidentally left behind. Cash takes longer to count out when it’s time to pay. Carrying around a lot of money can also make you feel apprehensive and like you’re a target for thieves. However, using cards might also lead to overspending and mountains of debt.

In the first quarter of 2025, Americans’ collective credit card balances rose to $841 billion. While credit cards aren’t necessarily a poor choice, carrying high balances from month to month definitely is. You end up paying more for those purchases when you factor in interest. Charging more than you can pay when the bill comes can have you paying a 16% to 22% annual premium. On some credit cards, the annual interest rate is even higher.

However, many credit and debit cards let you set up transaction alerts and digital receipts. You can set email alerts for daily or weekly limits. Say you want to cap your card spending at $150 a week. When you go over or meet that threshold, you’ll get a message in your inbox. You can also set these limits for individual transactions, which can help you monitor for potential fraud.

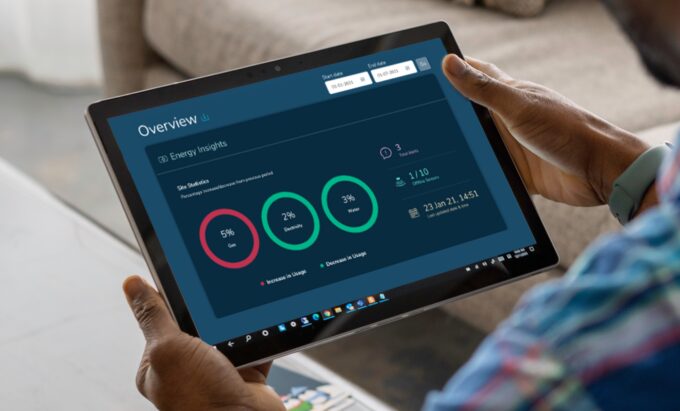

3. Utility Usage Monitoring Tools

Source: shprd.com

No one likes to throw money away, especially on utilities like electricity or water. Yet how much electricity and water you’re using isn’t something you can typically measure. Unless you have behind-the-scenes access to your meter, you can only guesstimate. But some utility companies and co-ops now provide that type of access through your online account.

By registering for online account access, you can see where your usage is in the middle of a billing cycle. You can also see trends between months and years, so you’ll know whether your usage is changing. Sometimes this can signal problems with aging HVAC equipment or irrigation systems. Other times, it might identify opportunities to change some of your habits, such as thermostat settings.

On average, utility bills are 13% of a household’s budget. This comes out to a typical yearly expense of $3,070. While that’s a smaller piece of the pie than a mortgage, utilities rank in the top four of household costs. Plus, it’s not a secret that many utility companies are raising rates to match the demand and rising costs. Monitoring your ongoing usage and trends can help with budgeting and decisions about energy-efficient upgrades.

4. Online Banking Software

Source: aarp.org

Online banking through a computer or mobile app isn’t just convenient. You can use the tracking features to know where your money is going each month. By categorizing each of your bills and payments, you’ll get a breakdown of your spending. These charts and other tools will help you create, stick to, or revise your budget.

Say you want to spend no more than 50% on essentials and 30% on wants, then direct the rest of your income to savings. You have an early retirement goal, and this budget will help you get there. With your bank’s online tools, you’ll know whether you’re meeting those targets. Perhaps you spent a little more than intended last month. Knowing you’re over your threshold, you can aim to cut back on expenses this month.

Depending on your bank’s software, you can monitor and forecast other financial areas. This includes things like changes to your credit score and how much paying extra on your mortgage will shorten its term. These tools will help you decide whether it’s worth forking over an additional $200 or more a month toward your mortgage principal. You can also forecast the effects of changes, such as refinancing to a lower interest rate or making lump-sum payments.

Tech for Finances

Technology is there to make your life easier. Why not use its full capabilities to help you manage your money? Using a variety of digital investment, spending, and budgeting tools will keep your financial choices aligned with your goals.